Real estate has always been a lucrative investment opportunity, but many people believe that it requires a significant amount of capital. Fortunately, affordable real estate investments allow you to unlock profitable opportunities without breaking the bank. Whether you’re a first-time investor or a seasoned professional, understanding how to make smart investments on a budget can pave the way to long-term financial success.

Why Choose Affordable Real Estate Investments?

Affordable real estate investments are ideal for those who want to diversify their portfolio while minimizing financial risks. Investing in budget-friendly properties allows you to build wealth steadily and offers a practical entry point for new investors. Here are some benefits:

1. Low Initial Capital Requirement

Investing in affordable real estate typically requires less money upfront. This makes it accessible to individuals with limited savings or those who want to test the waters before committing significant funds.

2. High ROI Potential

Low-cost properties often yield higher returns on investment (ROI) when compared to expensive properties. This is especially true in emerging markets where property values are expected to increase over time.

3. Diverse Investment Options

From foreclosed homes to fixer-uppers, affordable real estate offers various investment options that suit different financial goals and risk appetites.

Types of Affordable Real Estate Investments

Understanding the different types of affordable investments helps you identify which strategy aligns with your financial goals.

1. Foreclosed Properties

Foreclosed properties are homes that have been repossessed by lenders due to the owner’s inability to meet mortgage obligations. These properties are often sold at below-market prices, presenting excellent investment opportunities.

2. Fixer-Uppers

These are properties that require renovations. By purchasing a home in need of repair, you can add value through improvements, significantly increasing the resale value.

3. Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without owning physical property. These funds pool money from multiple investors to purchase income-generating real estate assets.

4. Rental Properties

Owning rental properties can provide steady income. Small multi-family homes, studio apartments, and single-family homes in affordable neighborhoods are excellent choices.

How to Identify Profitable Real Estate Opportunities

The success of any investment depends on thorough research and analysis. Here are key steps to identify profitable opportunities:

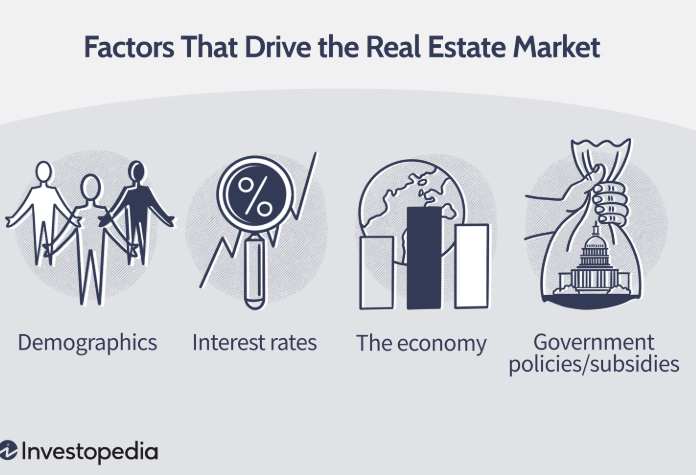

1. Research the Market

Analyze market trends, such as rising property values, growing populations, and new developments in the area.

2. Check Affordability Metrics

Evaluate affordability by comparing the property’s price to the average income in the area. Affordable investments should fit within the budget constraints of most buyers or renters.

3. Assess the Location

Properties in up-and-coming neighborhoods or near essential amenities, such as schools and public transport, are likely to see appreciation in value over time.

4. Conduct a Cost Analysis

Calculate all costs, including purchase price, renovation expenses, taxes, and insurance. Ensure that potential rental income or resale value outweighs these costs.

Financing Affordable Real Estate Investments

Financing plays a critical role in making affordable real estate investments successful. Consider these options:

1. FHA Loans

Federal Housing Administration (FHA) loans are ideal for low-income investors, as they require lower down payments and have lenient credit score requirements.

2. Private Money Lenders

Private money lenders offer loans for real estate investments, especially for those looking to flip properties or purchase rentals.

3. Seller Financing

In some cases, sellers may offer financing to buyers. This option is particularly beneficial for properties that may not qualify for traditional loans.

Tips for First-Time Investors

If you’re new to real estate investing, these tips will help you make informed decisions:

- Start Small: Begin with low-cost properties to minimize risks and gain experience.

- Learn from Experts: Join local real estate groups or attend seminars to network with experienced investors.

- Use Property Management Tools: Software tools can help you manage rental properties and track expenses efficiently.

Benefits of Affordable Real Estate Investments

The advantages of budget-friendly real estate investments are numerous:

- Financial Freedom: Generate passive income and build long-term wealth.

- Portfolio Diversification: Reduce risks by investing in multiple properties.

- Community Impact: Revitalize neighborhoods by improving neglected properties.

Side Effects of Poor Investment Decisions

While affordable real estate investments offer great potential, poor decisions can lead to pitfalls:

- Hidden Costs: Unexpected repairs or legal fees can eat into profits.

- Market Risks: Economic downturns can reduce property values.

- Management Challenges: Poor tenant management can lead to losses.

FAQs

1. Are affordable real estate investments profitable?

Yes, with proper research and planning, affordable real estate investments can yield high returns.

2. What is the best location for affordable real estate?

Emerging markets and neighborhoods undergoing development are ideal locations for affordable real estate.

3. How can I minimize risks in real estate investing?

Conduct thorough research, diversify your portfolio, and have a clear exit strategy to minimize risks

Customer Reviews

- John D.: “Investing in affordable real estate allowed me to purchase my first rental property without draining my savings. The returns have been excellent.”

- Maria S.: “Fixer-uppers are a game-changer! I bought a property at half its market value and flipped it for a 40% profit after renovations.”

- Michael T.: “REITs have been my go-to for affordable real estate investments. It’s hassle-free and still profitable.”